Build & Run Your Business in Canada Through Entrepreneur Work Permits

Explore LMIA-exempt work permit options designed for entrepreneurs ready to launch or expand their business in Canada. Discover how you can legally work, direct, and grow your company under Canada’s entrepreneur visa pathways.

Work Permit Options for Entrepreneurs

Canada offers several work permit options tailored to entrepreneurs, investors, and business owners. Whether you’re establishing a new venture, expanding a multinational, or investing in a Canadian business, here are four key LMIA-exempt pathways available to you.

CUSMA Investor Work Permit

This work permit allows U.S. or Mexican citizens to obtain a LMIA-exempt work

permit to develop and direct a business they have substantially invested in within

Canada, under the International Mobility Program.

permit to develop and direct a business they have substantially invested in within

Canada, under the International Mobility Program.

Services Offered

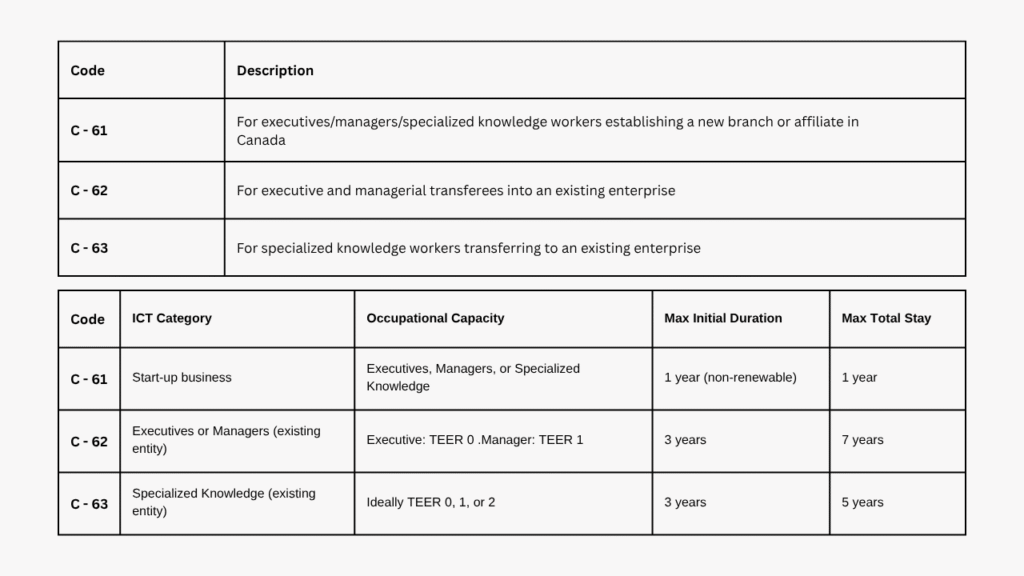

Intra-Company Transferee (ICT) Work Permit – C 61, C 62 and C 63 Work permit

If the applicant worked in a multinational company who is setting up operations in Canada and is looking to transfer the worker to Canada to work in a similar position as in the parent or branch company, then the worker can apply for a work permit to work in the company’s branch or subsidiary in Canada.

Services Offered

C11 category Work Permit – International Mobility Program (IMP)

The C11 LMIA-exempt work permit category allows foreign nationals to work in Canada if their employment will bring significant social, cultural, or economic benefits to Canadians or permanent residents. It is used in cases where no specific LMIA exemption applies, but there is a strong justification for issuing a permit without a Labour Market Impact Assessment (LMIA).

Services Offered

C10 Work Permit (Significant Benefit – IRPR R205(a))

The C10 LMIA-exempt work permit category allows foreign nationals to work in Canada if their employment will bring significant social, cultural, or economic benefits to Canadians or permanent residents. It is used in cases where no specific LMIA exemption applies, but there is a strong justification for issuing a permit without a Labour Market Impact Assessment (LMIA).